The aim of Advanced Taxation – CYP (ATX-CYP) is to ensure candidates can provide individuals and businesses with the information and advice they require regarding the impact major Cyprus taxes may have on various financial decisions and situations.

The emphasis is on the practical application of tax rules to client scenarios and the provision of clear advice and recommendations. It should also be noted that the ability to communicate with clients, the Tax authorities and other professionals, is one of the four main abilities required of candidates sitting ATX-CYP.

The syllabus

ATX-CYP is directly connected to Taxation – CYP(TX-CYP). Knowledge and understanding of the technical content of TX-CYP is therefore vital for candidates to be successful at ATX-CYP. It is quite possible that the technical content of an ATX-CYP question is drawn mainly from the TX-CYP syllabus. However, such a question will require the analysis of information provided and the application of technical knowledge to the situation, in order to resolve a problem.

The ATX-CYP syllabus expands on the coverage of income tax, corporation tax, capital gains tax, special defence contribution and VAT. It also introduces stamp duties and transfer fees. The syllabus is wide, as befits an optional exam at this level. New technical content clearly identified in the Study Guide, will be examined regularly.

While no part of the syllabus is more important than others, it should be recognised that knowledge of all technical areas of the syllabus is essential in order to pass the exam.

The technical areas included within the syllabus are set out in the ATX-CYP syllabus and study guide. Candidates should always check the website for the latest Study Guide and ATX examinable documents relevant to their exam session, to ensure that the learning they are about to embark on is up to date.

Candidates are required to:

- Explain the legislation

- Apply their knowledge to the scenario of the exam question

- Calculate the relevant taxes

- Compare the options applicable in the questions

- Be able to advise on the best option and suggest effective and legal ways to reduce tax liabilities for the client

- Be able to advise on the statutory requirements – ie tax return submission dates and tax payable due dates

All candidates must be familiar with the new legislation changes enacted up to 30 September of the previous year. See the syllabus and study guide for further details on this.

The style and format of the exam

Format and structure

The ATX exams consist of two sections: A and B. From June 2023 there will be only three questions in each ATX exam, instead of four, with all questions being compulsory. The new structure of the exam is set out below:

Section A

Question 1 – 50 marks (including 10 professional skills marks and 5 ethics marks)

Section B

Question 2 – 25 marks (including 5 professional skills marks)

Question 3 – 25 marks (including 5 professional skills marks)

Each question could examine any area of the syllabus and will typically examine more than one tax. For further information about what is examinable, please refer to the syllabus and study guide for ATX CYP.

Professional skills

You may be aware that in exams up to and including December 2022, there were four professional skills marks available in Question 1 of each of the ATX-CYP exams.

With effect from the June 2023 exam session, there will be a total of 20 professional skills marks across the ATX exams as a whole. This change will be brought in for the ATX CYP exam from the June 2023 exam session to coincide with the start of the new exam year. You should refer to the Format and Structure section above for details of how many professional skills marks will be available for each question.

The professional skills are expected to be evident in the technical points you make. They are not marks to be earned separately, instead they are awarded by reference to the technical work you do. You should therefore treat the exam as being out of 80 (as opposed to 100) marks, such that you will have just over 2.4 minutes per mark in the exam. When compared with the previous format of the exam, this means you will have more time to think about:

- the requirement

- what you want to say, and

- how you want to say it.

This should give you the time to exercise your professional skills when answering each question.

Look at some of the resources available to help you prepare for this change.

Ethics

Ethical issues have been examined in the ATX UK exam for many years. With effect from June 2023, question 1 of all ATX variant exams will also contain five marks for demonstrating an understanding of the key ethical principles which are relevant in the context of the provision of tax advice.

Under the ACCA Code of Ethics and Conduct there are five fundamental principles of ethics which establish the standard of behaviour expected for a professional accountant and member of ACCA.

You are expected to be aware of the five fundamental principles and to be able to apply them to situations which will be presented to you in the exam. For further guidance on how ethics may be examined in the ATX exams, along with a number of detailed examples, you should refer to the article Ethics questions in the ATX exams.

Presentational enhancements

With effect from the June 2023 exam session, the ATX examining teams have introduced a number of changes to the way information is presented to you to help you navigate your way around the exam. These enhancements have been made in recognition of the new 50-mark question in Section A and to help you manage the information provided more easily in the exam. The enhancements are summarised below.

Summary of topics covered

The background screen for each question in your exam provides contextual information such as the date assumption (where relevant), the scenario background and a list of exhibits. Going forward this screen will also include a bullet point list of the main issues which will be examined in the question.

This is to help you see at a glance the key topics which will be examined in the question, before you read the detailed exhibits.

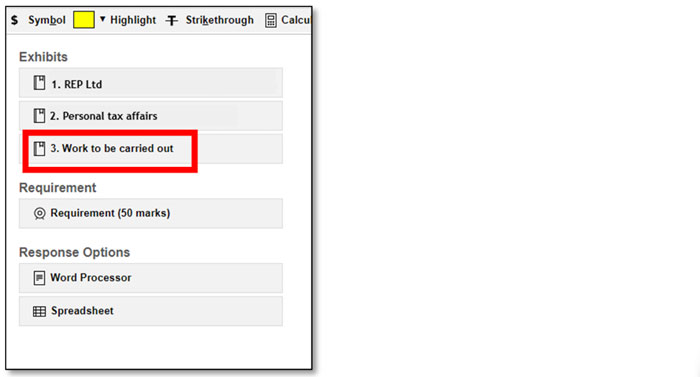

‘Work to be carried out’ exhibit

With effect from the June 2023 ATX-CYP exams, the exhibit which contains the detailed requirements will be labelled ‘Work to be carried out’ as you can see in the example below:

This should make it straightforward for you to distinguish this exhibit from the others. This ‘Work to be carried out’ exhibit contains the detailed requirements and the mark allocation for each requirement.

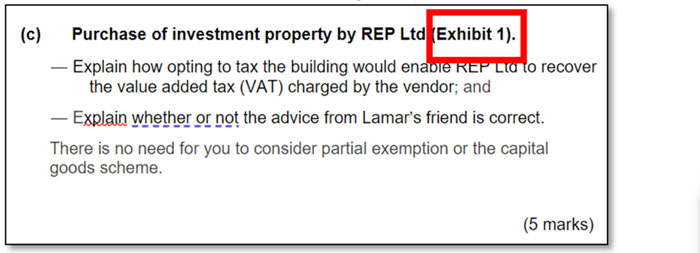

Exhibit signposting

The ‘Work to be carried out’ exhibit will also signpost which of the other exhibits are relevant for each task, as can be seen in the following example taken from ATX-UK:

This enhancement is in recognition that there is more information for you to manage in a 50-mark question than in a 35-mark question and this helps to direct you to the exhibit(s) you need for a particular task. If you do not need to refer to an exhibit to address a requirement, for example with certain ethical requirements, no direction will be given.

In addition to this, where possible, certain requirements in Question 1 will be distinct from one another. The purpose of this is to help you to perform as well as you can across the question, even if there are certain requirements which you find challenging and/or struggle to answer fully. If you do find a particular aspect challenging, you should still try to answer it as best you can in the time available to try to score as many of the marks available as you can.

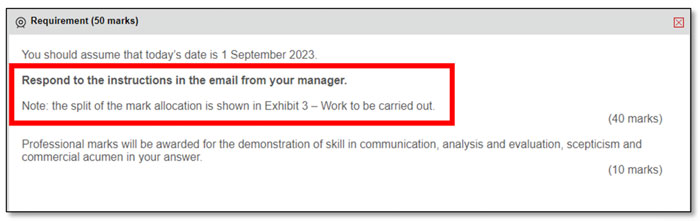

Requirement signposting

The requirement exhibit itself will simply say something like ‘Respond to the instructions in the email from your manager’, followed by clear guidance to refer to the ‘Work to be carried out’ exhibit. As mentioned above, the detailed allocation of marks has also been moved into the ‘Work to be carried out’ exhibit. Once you have read the high-level requirement, you can close the requirement window and refer only to the detailed requirements in the ‘Work to be carried out’ exhibit, minimising the number of windows you need to have open at any one time.

In summary

Throughout the exam, candidates are expected to be able to identify issues, as well as demonstrate detailed basic and advanced knowledge of the Cyprus tax system.

Calculations are normally required to support advice and explanations, and are not used in isolation. It is often left upon the candidates to decide which calculations to produce to do this in the most efficient manner. Advice as to how to approach a given issue may be provided in the question.

There is no specific allocation of marks for numerical calculations versus narrative balance within TX-CYP and ATX-CYP. However, TX-CYP is weighted towards numerical calculations, whereas ATX-CYP is weighted more towards narrative explanations.

The ability of candidates to explain their treatment, opinion and advice is vital.

It is important to note that this does not mean that candidates need to write with perfect grammar or spelling; it means they need to be able to explain and communicate clearly what they want to say.

Approach to the exam

When preparing for the ATX-CYP exam, candidates need to go through several stages in order to be successful.

- Acquire the knowledge and obtain a solid understanding of the subject area. For both levels within the taxation stream, a good understanding of the Cyprus tax system is vital to a successful exam result. Candidates exempted from the TX-CYP exam, should ensure they have a solid knowledge of TX-CYP before joining the ATX-CYP course. They must ensure they revise the current TX-CYP syllabus and have no knowledge gaps.

- Use the syllabus provided on the website and make sure you cover it all. Use recognised material available in the market to help you obtain a solid understanding of the syllabus.

- Consolidate understanding questions that focus on specific areas. Start first with the TX- CYP questions which are simpler and focus on individual areas of the syllabus. Although these questions may assist understanding of the basic approach to the topic, they do not necessarily provide a grasp of exam technique for the ATX-CYP exam.

- To improve your exam technique and approach, practice exam standard questions written by both “ACCA’s Recognised Content Provider (RCP)” and ACCA past exam questions. All ACCA’s exams require candidates to apply their knowledge at an appropriate level for the stage of the exam. Candidates who attempt exams without practicing exam-standard questions are unlikely to pass as there is no other way to master the required exam technique or technical understanding.

- Special care should be taken when students are using ACCA past exams which are included on the ACCA Practice Platform. These exams are based on the legislation in force at the time of the exam session. This means that some of the content of the questions or answers may be out of date.

- Recognised Content Providers (RCPs) are allowed to use the content from these exams and reproduce and update them, so their content is relevant to the related exam session. RCPs may also write their own exam standard questions which may focus on areas that have not yet been examined. Students are encouraged to acquire the recognised content materials and use it as a reference for their studies.

- When practicing exam standard questions, it is vital to spend time reviewing your answer against the model answer to learn what was done well and what needs to be improved. Where mistakes were made, effort must be made not to repeat them. It should be noted that the model answers always contain much more than a candidate needs to write to achieve a good pass. Remember that the marking scheme usually contains extra marks.

In the exam

When students are sitting an exam, even though the questions are all compulsory, students may prefer to navigate through the questions and start with the one that they feel most comfortable with. In addition, students should pay attention to the following in order to maximise their chances of success in the ATX-CYP exam.

- Read the requirement carefully. The requirements are worded very carefully to provide guidance as to the style and content of the answers. Pay attention to the command words (ie calculate, explain etc.) and any additional guidance given in the question.

- Produce a plan and write a list of what is required in the question. It may be helpful to highlight the tasks as they are addressed. Remember that marks are only awarded for satisfying the requirements and not for other information, even if it is technically correct.

- Need to use headings and subheadings – eg

Headings

(1) Income Tax Implications

(2) Capital Gains Tax implications

(3) VAT implications

Sub-headings

(1) Employment Income

(2) Rental Income

(3) Interest/Dividends

(4) Foreign Pension

Copying and pasting the relevant part of the question requirements into your spreadsheet or word processing document is a useful tool for creating subheadings in your answer.

- Students must write the legislation relevant to the question and provide as many explanations as necessary. Then they must relate the legislation (knowledge) to the case scenario and should not provide general explanations or long introductions. They should be specific and precise. Candidates should think before they write, and then write whatever is necessary to satisfy the requirement.

Do not rewrite the facts of the question; this will not give you any marks at all.

- When students are writing and explaining the legislation, the maximum detail is required. They need to reflect in their answer the exact provisions of the relevant legislation. Using general (sometimes vague) wording in their answers will not give them any credit, (not even partial sometimes).

- They must always consider all relevant taxes – they should not forget the Social Insurance Contribution, General Health Scheme, Transfer fees and Stamp duties where applicable.

- If the question includes a requirement to advise on how to reduce the client’s taxes payable, always suggest legal methods.

- When candidates are asked to calculate, there is no need to explain what they are going to do before they do it. Just show the calculation, ensuring it is suitably labelled and try to carry it out in the most efficient manner. If there is a need for advice, compare the options and suggest the best course of action.

- Pay attention to the number of marks available – this provides a clear indication of the amount of time that should be spent on each question part.

- Last but not least, when attempting the real exam, it is important to follow the very detailed instructions of the exam and answer all the questions. This way a candidate will have the best possible chance of passing and securing as many technical and professional marks as possible. When a candidate does not answer all the exam questions, they are reducing their chance of passing as they will not be marked out of the total marks available, but only the maximum marks attributed to the questions or question parts that have been attempted.

Good luck with your ATX-CYP exam!

Polina Jacovidou Michael, PwC’s Academy Cyprus