Part 2 of 4

This is the Finance Act 2019 version of this article. It is relevant for candidates sitting the ATX-UK exam in the period 1 June 2020 to 31 March 2021. Candidates sitting ATX-UK after 31 March 2021 should refer to the Finance Act 2020 version of this article (to be published on the ACCA website in 2021).

In Part 1 of this article we reviewed the definitions of a group relief group and a capital gains group.

The remaining parts of this article examine the tax planning issues relating to group relief groups. This part looks at companies which are resident overseas and how to plan the distribution of losses to members of a group. Throughout this review of tax planning issues, the term ‘losses’ will be used to represent any/all tax attributes that can be surrendered via group relief.

Companies resident overseas

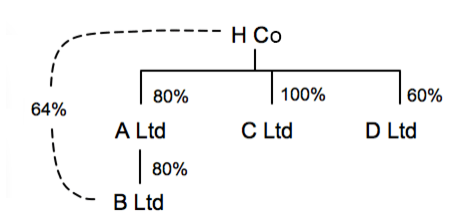

Companies resident overseas are included within a group relief group. However, losses can only be surrendered between companies that are resident in the UK or are resident overseas but have a permanent establishment in the UK. If the H Ltd group were owned by H Co, as set out below (where H Co is a company resident and trading outside the UK and the European Union) rather than H Ltd, the members of the group relief groups would not change. However, losses could only be surrendered between A Ltd and C Ltd and between A Ltd and B Ltd.

Figure 1: The structure of the H Co group of companies

Planning the distribution of losses to members of the group

The value of a company’s losses is maximised by offsetting them against those profits that would otherwise be taxed at the highest rate of tax. This means that a company should look to carry back its losses (after making a current year claim), if possible, to obtain relief at a higher rate, before considering group relief. However, once we come to group relief, because all companies, regardless of their level of profits, pay corporation tax at the same rate, the amount of tax that can be saved via the offset of losses is always the same (unless double tax relief is available – see Part 4 of this article).

However, there is still the issue of timing and cash flow to consider. There are two aspects to this:

- A trading loss can be carried back (after a current period offset) and deducted from the company’s total profits of the previous 12 months. This is advantageous from a cash flow point of view because it relieves the losses earlier than a surrender via group relief. It may also save more tax if the rate of tax in the earlier period is higher than that in future periods.

- As far as group relief is concerned, losses should be surrendered to companies which are required to pay corporation tax by instalments.

The first objective should be to reduce a company’s augmented profits to the level of the quarterly payments threshold. This will mean that the company is no longer required to pay its tax by instalments.

The second objective should be to surrender losses to any other company which has profits in excess of the quarterly payments threshold as this will reduce that company’s corporation tax liability and, consequently, the quarterly payments required.

Conclusion

In the exam you should take care to identify the residence status of companies and the location of any permanent establishments as this will affect the planning opportunities available.

Planning the distribution of losses between group members requires a clear understanding of the cash flow implications of corporation tax payments.

Note: Corporation tax issues are considered in two further articles:

- Corporation tax for ATX-UK

- Corporation tax – Groups and chargeable gains for ATX-UK

Written by a member of the ATX-UK examining team

The comments in this article do not amount to advice on a particular matter and should not be taken as such. No reliance should be placed on the content of this article as the basis of any decision. The authors and ACCA expressly disclaim all liability to any person in respect of any indirect, incidental, consequential or other damages relating to the use of this article.