Part 2 of 4

This is the Finance Act 2014 version of this article. It is relevant for candidates sitting the Paper P6 (UK) exam in the period 1 April 2015 to 30 June 2016. Candidates sitting Paper P6 (UK) after 30 June 2016 should refer to the Finance Act 2015 version of this article (to be published in 2016).

In the first part of this article we looked at some basic rules concerning the international aspects of IT, CGT and IHT. The remaining parts of this article look at the three taxes in more detail together with the remittance basis.

Overseas income

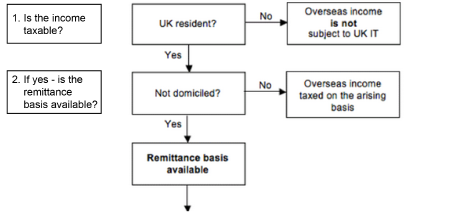

The key factor when considering the taxation of overseas income is the individual’s residence position. Figure 1 sets out an individual’s liability to UK income tax in respect of overseas investment income and trading income.

Figure 1 – UK IT on overseas investment income and trading income

Figure 1 relates to the taxation of overseas investment income and trading income only. It has already been recognised that UK source income is always subject to UK IT regardless of the individual’s tax status. Overseas employment income is considered below, following Example 1.

Note the following:

- Where an individual is not UK resident, overseas income is not subject to UK IT. There is no need to consider the person’s domicile status or the remittance basis. This is true regardless of whether or not the income is brought into the UK.

- Where an individual is UK resident, overseas income is subject to UK IT. The manner in which it is taxed depends on the individual’s domicile status. The remittance basis (see below) is available if the individual is not domiciled in the UK.

The remittance basis

A UK resident individual who is not domiciled in the UK may choose to be taxed on overseas income and capital gains on the remittance basis.

Under the remittance basis, amounts are subject to UK tax only if brought into the UK. For example, an individual with overseas bank interest would not be liable to UK IT on that interest if he could show that it has not been brought into the UK. This could be achieved by, for example, showing that it has not been removed from the overseas bank account.

A remittance is regarded as having been made where money or other property derived from offshore income/gains is brought into the UK.

Individuals who qualify for the remittance basis can choose each tax year whether or not to pay tax on the remittance basis.

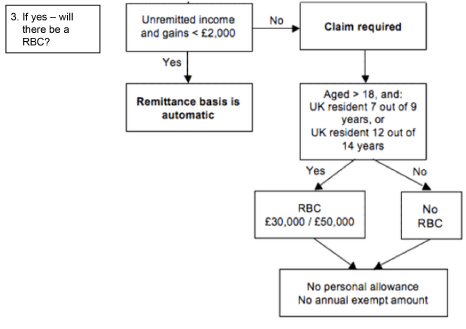

Figure 2 illustrates the three stages of the remittance basis. It is useful to think of the rules in stages as it avoids confusion and enables the issues to be addressed in the correct order.

- It is first necessary to consider the status of the individual in order to determine whether the remittance basis is available.

- The second issue is whether the remittance basis is available automatically or needs to be claimed.

- Finally, if a claim is required, the need to pay the remittance basis charge (RBC) must be considered.

Figure 2 – The remittance basis

Example 1 – Adele

Adele came to the UK in 2013/14 but did not become resident until 2014/15. She is domiciled outside the UK. Adele has employment income in respect of her job in the UK and interest arising on an overseas bank account of £4,000 per year. Adele’s liability to UK IT is as follows:

- Her employment income is in respect of UK duties. Accordingly, it will be subject to UK IT in both 2013/14 and 2014/15.

- In 2013/14, the overseas bank interest will not be subject to UK IT as Adele is not resident in the UK.

- In 2014/15, Adele is UK resident and will be taxed on her overseas bank interest as well as her UK source employment income. However, she can claim to be taxed on the remittance basis as she is not domiciled in the UK. There will be no need for Adele to pay the RBC as she has not been UK resident for seven of the nine tax years prior to 2014/15.

Conclusion

Flow diagrams are useful in this area of taxation as they provide a clear structure of the method required to identify an individual’s tax position. When you learn these rules, make sure that you learn them as part of a coherent whole and not as a list of unrelated points.

Written by a member of the Paper P6 examining team

The comments in this article do not amount to advice on a particular matter and should not be taken as such. No reliance should be placed on the content of this article as the basis of any decision. The author and the ACCA expressly disclaims all liability to any person in respect of any indirect, incidental, consequential or other damages relating to the use of this article.