This article provides a broad overview of microeconomics. It is intended to introduce key topics to those who have not studied microeconomics, and to offer a revision to those who have done so

What is microeconomics?

Microeconomics is the branch of economics that considers the behaviour of decision takers within the economy, such as individuals, households and firms. The word ‘firm’ is used generically to refer to all types of business. Microeconomics contrasts with the study of macroeconomics, which considers the economy as a whole.

Scarcity, choice and opportunity cost

The platform on which microeconomic thought is built lies at the very heart of economic thinking – namely, how decision takers choose between scarce resources that have alternative uses. Consumers demand goods and services and producers offer these for sale, but nobody can take everything they want from the economic system. Choices have to be made, and for every choice made something is forgone. An individual may choose to buy a car, but in doing so may have to give up a holiday which they might have used the money for, if they had not chosen to buy the car. In this example, the holiday is the opportunity cost of the car. Just as individuals and households make opportunity cost decisions about what they consume, so too do firms take decisions about what to produce, and in doing so preclude themselves from producing alternative goods and services.

Producers also have to decide how much to produce and for whom. A simple answer to the first question might be: ‘As much as possible of course, using all the resources we can’. However, classical economists teach us that if we combine all of the factors of production – land, labour, capital and the entrepreneur – in different ways, we can get some surprising results. One of the most famous of these is confirmed by the law of diminishing returns. This law states that if we keep on adding variable factors of production (such as labour) to fixed factors (such as land), we will get proportionally less output from each additional unit of factor added until, eventually, overall output will start to decrease with each additional unit of factor added.

The price mechanism

Much of the study of microeconomics is devoted to analysis of how prices are determined in markets. A market is any system through which producers and consumers come together. In early subsistence economies, markets were usually physical locations where people would come together to trade. In more complex economic systems, markets do not depend on humans actually meeting one another, so many markets today arise when producers and consumers come together less directly, such as by post and on the internet.

Producers and consumers generate forces that we call supply and demand respectively, and it is their interaction within the market that creates the price mechanism. This mechanism was once famously described as the ‘invisible hand’ that guides the actions of producers and consumers.

Markets are essential to produce the goods and services required for everyday life. Even if an individual can produce all the food needed to survive, that person will still need clothes, shelter and other necessities. Therefore, from very early times, communities learned that they would benefit from exchange. The crudest form of exchange was barter, but the evolution of money as a medium of exchange and unit of account accelerated the development of the process.

But how would people know what they could charge, or what they should pay, for goods and services? Before any formal thought was given to this, traders soon discovered that if they fixed their prices too low they would soon run out of inventory, while if they set their prices too high they would not sell what they had produced. In physical markets there would often be perfect knowledge, as traders would be able to check the prices of those who had similar goods and services to trade, simply by walking around the stalls. Once markets became more remote, less perfect knowledge of prices was inevitable and the process became less certain.

Alfred Marshall, whose Principles of Economics was published in 1890, drew heavily on the writings of Jevons and Mill. However, much of what you read today about supply and demand, elasticity, revenues and costs and marginal utility are based on Marshall’s thoughts. Marshall provided a base upon which formal analysis of supply and demand, and consequently the determination of prices in markets, could be built.

Demand

Demand is created by the needs of consumers, and the nature of demand owes much to the underpinning worth that consumers perceive the good or service to have. We all need necessities, such as basic foodstuffs, but other products may be highly sought after by some and regarded as worthless by others.

The level of demand for a good or service is determined by several factors, including:

- the price of the good or service

- prices of other goods and services, especially substitutes and complements

- income

- tastes and preferences

- expectations.

In orthodox economic analysis, these determinants are analysed by testing the quantity demanded against one of these variables, holding all others to be constant (or ceteris paribus).

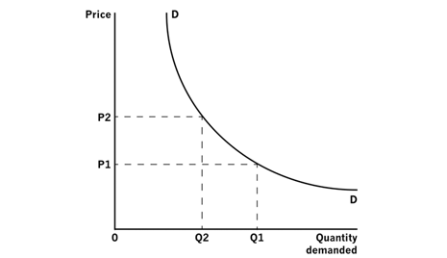

The most common way of analysing demand is to consider the relationship between quantity demanded and price. Assuming that people behave rationally, and that other determinants of demand are constant, the quantity demanded has an inverse relationship with price. Therefore, if price increases, the quantity demanded falls, and vice versa. Figure 1 portrays the conventional demand curve.

Figure 1: Demand curve

For any change in price, there is an inverse change in quantity demanded. The price increase from OP1 to OP1 results in a reduction in quantity demanded from OQ1 to OQ2.

A change in price will cause a movement along the curve. When the price increases, the quantity demanded will reduce. This happens with most types of goods, with some bizarre exceptions. Demand for what are known as ‘Giffen goods’ actually rises with an increase in the price for such goods. For example, when the price of rice increases in some regions of China, more rice will be purchased, as there is not enough income left over to some consumers to purchase higher value food items.

If we then relax the assumption that other variables (such as income and tax rates, etc) are constant, what happens then? An increase in income will often cause the demand for a good or service to increase, and this will shift the whole curve away from the origin. Likewise, a reduction in the price of a substitute good will move the demand curve towards the origin as the good in question will then be less attractive to the consumer.

While these generalisations are useful, it is important to remember that economic behaviour is based on human decisions, and so we can never predict fully how people will act. For example, some very basic foodstuffs will become less popular as incomes increase and when consumers find that they no longer have to subsist on basic diets.

Supply

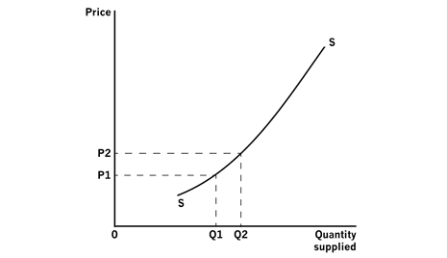

Supply refers to the quantity of goods and services offered to the market by producers. Just as we can map the relationship between quantity demanded and price, we can also consider the relationship between quantity supplied and price. Generally, suppliers will be prepared to produce more goods and services the higher the price they can obtain. Therefore, the supply curve – when holding other influences constant – will slope upwards from left to right, as illustrated in Figure 2.

Figure 2: Supply curve

There is a direct relationship between price and quantity supplied. An increase in price from OP1 to OP2 results in an increase in quantity supplied from OQ1 to OQ2.

The determinants of supply are:

- price

- prices of other goods and services

- relative revenues and costs of making the good or service

- the objectives of producers and their future expectations

- technology.

Generally, a firm will maximise profit when its marginal revenue (the revenue arising from selling one extra unit of production) equals its marginal cost (the cost of producing that one extra unit of production). However, a firm may continue to produce as long as the marginal revenue exceeds its average variable costs, as in doing so it will be making a contribution towards covering its fixed costs.

Following the same rationale as applied earlier, a movement along the supply curve will be brought about by a change in price, but a movement of the whole curve will be caused by a determinant other than price.

Elasticity

The concept of elasticity is concerned with the responsiveness of quantity demanded or quantity supplied to a change in price. If a small change in price brings about a massive change in quantity demanded, the price elasticity of demand is said to be highly elastic. Conversely, if a change in price has little or no effect on the quantity demanded, the demand is said to be highly inelastic. This concept is obviously very important to producers, who have to estimate the potential effects of their pricing strategies over time. It is also important to government finance departments, which have to model the implications of imposing sales taxes on goods and services in order to predict tax revenues.

Price elasticity of demand is measured by dividing the change in quantity demanded by the change in price and, conversely, price elasticity of supply is measured by dividing the change in quantity supplied by the change in price. Price elasticity of demand occurs when an increase in price leads to a reduction in total revenue (p x q) between those two points on the demand curve, and price inelasticity occurs when an increase in price leads to an increase in total revenue. Unitary elasticity occurs when the change in price

causes no change in total revenue.

In addition to price elasticity, there are similar concepts of relevance to your study:

- Income elasticity is the responsiveness of quantity demanded or supplied to a change in income.

- Cross elasticity is the responsiveness of quantity demanded or supplied of good X to a change in price of good Y.

Equilibrium

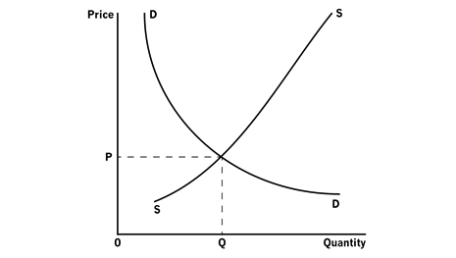

Assuming all determinants of supply and demand are to be constant except price, a firm will produce where the supply curve intersects the demand curve. By definition, this is the point at which the quantity supplied equals the quantity demanded (Figure 3).

Price is determined at the intersection of the supply and demand curves.

If the price is set above the equilibrium price, this will result in the quantity supplied exceeding the quantity demanded. Therefore, in order to clear its inventory, the company will need to reduce its price.

Conversely, if the price is set below the equilibrium price, this will result in an excess demand situation, and the only way to eliminate this is to increase the price.

Market intervention

In capitalist systems, allowing markets to operate freely is considered to be desirable, but it is generally accepted that market forces cannot be permitted to operate for all the goods and services required by society. Some goods and services are ‘public goods and services’, which means that they can only be provided adequately by intervention. These include law and order and the military. For this reason, the government or supra-national organisations may choose to introduce and maintain systems that will ensure that such goods and services are produced, and may fix prices either above or below the equilibrium price.

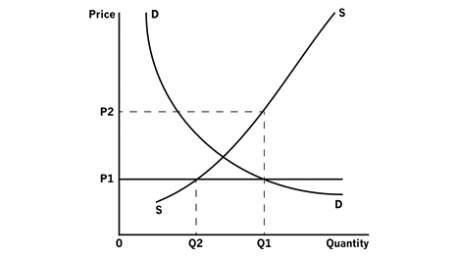

A maximum price is sometimes imposed in order to protect consumers. This will result in a situation in which the quantity demanded will exceed the quantity supplied, provided the maximum price is struck below the equilibrium price (Figure 4). There are numerous examples of this in real life. During World War 2, the UK government intervened in this way in order to ensure that families could obtain adequate supplies of goods such as bread, butter and petrol. One consequence of this is that there was excess demand in the system, and this led to an illegal market developing.

Figure 4: Maximum price

Maximum price is OP1. At this point, the quantity demanded (OQ1) exceeds quantity supplied (OQ2). The 'black market' price is OP2.

A minimum price is sometimes imposed in order to protect producers. Here, the quantity supplied will exceed the quantity demanded, provided the minimum price is struck at a level above the equilibrium price. One of the goals of the European Union (EU) has been to protect the agricultural sector, and the common agricultural policy is a minimum price system. As a consequence of this, the agricultural sector of the EU has periodically generated surpluses.

The impact of intervention in the price system should not be seen as undesirable in all cases. However, one of the contributions that microeconomic analysis makes is that it teaches us that there will be consequences of such interventions, and society has to manage those consequences.

Theory of the firm

The theory of the firm is a branch of microeconomics that examines the different ways in which firms within an industry may be structured, and seeks to derive lessons from these alternative structures.

Perfect competition

A perfectly competitive market is one in which:

- there are many firms producing homogeneous goods or services

- there are no barriers to entry to the market or exit from the market

- both producers and consumers have perfect knowledge of the market place.

Under such conditions, the price and level of output will always tend towards equilibrium as any producer that sets a price above equilibrium will not sell anything at all, and any producer that sets a price below equilibrium will obtain 100% market share. The demand ‘curve’ is perfectly elastic, which means that it will be horizontal.

As these conditions imply, there are few if any examples of perfectly competitive markets in real life. However, some financial markets approximate to this extreme model, and there is no doubt that in some fields of commerce the development of the internet as a trading platform has made the markets for some products, if not perfectly competitive, then certainly less imperfect.

Monopoly

A monopoly arises when there is only one producer in the market. It should be noted the laws of many countries define a monopoly in less extreme terms, usually referring to firms that have more than a specified share of a market.

Unlike perfect competition, monopolies can and do arise in real life. This may be because the producer has a statutory right to be the only producer, or the producer may be a corporation owned by the government itself.

A monopoly enjoys a privilege in that it can strike its own price in the market place, which can give rise to what economists call ‘super-normal profits’. For this reason, monopolies are usually subject to government control, or to regulation by non-governmental organisations.

Oligopoly

An oligopoly arises when there are few producers that exert considerable influence in a market. As there are few producers, they are likely to have a high level of knowledge about the actions of their competitors, and should be able to predict responses to changes in their strategies.

The minimum number of firms in an oligopoly is two, and this particular form of oligopoly is called a duopoly. There are several examples of duopolies, including the two major cola producers and, for several product lines, Unilever and Procter & Gamble. However, markets dominated by perhaps up to six producers could be regarded as oligopolistic in nature. Where a few large producers dominate a market, the industry is said to be highly concentrated.

Although it is difficult to make generalisations across all oligopolistic markets, it is frequently noted that their characteristics include complex use of product differentiation, significant barriers to entry and a high level of influence on prices in the market place.

Monopolistic competition

Monopolistic competition arises in markets where there are many producers, but they will tend to use product differentiation to distinguish themselves from other producers in the market. Therefore, although their products may be very similar, their ability to differentiate means that they can act as monopolies in the short-run, irrespective of the actions of their competitors.

For monopolistic competition to exist, consumers must know of – or perceive – differences in products sold by firms. There tend to be fewer barriers to entry or exit than in oligopolistic markets.

Conclusions

Those embarking on their studies for BT/FBT will quickly become aware that the syllabus is broad but shallow. It is essential to cover a wide range of topics, without necessarily having to study each component part in depth. The purpose of this article has therefore been to provide basic information on the most important areas of microeconomics without any intention of exploring any individual topic in detail. Awareness of key principles is important, but candidates should not assume that they have to be experts in order to deal with the objective test questions in the exam.

Written by a member of the BT/FBT examining team