Policy and insights report

This timely report examines the effects of risk cultures in the banking industry

ACCA's latest report examines risk cultures in the banking industry and how financial institutions can learn from the failures of the likes of Credit Suisse and SVB.

Building on 'Risk culture: Building resilience and seizing opportunities', this is part of ACCA’s ongoing series of reports exploring what drives risk governance and cultures across different industries. See Risk culture: A special report on China's SOEs.

For this special focus on banking, ACCA held regional roundtables, forums and one-on-one interviews with members working at or with financial institutions around the world, discussing what is next for this industry and how it positions itself in a fast-changing world.

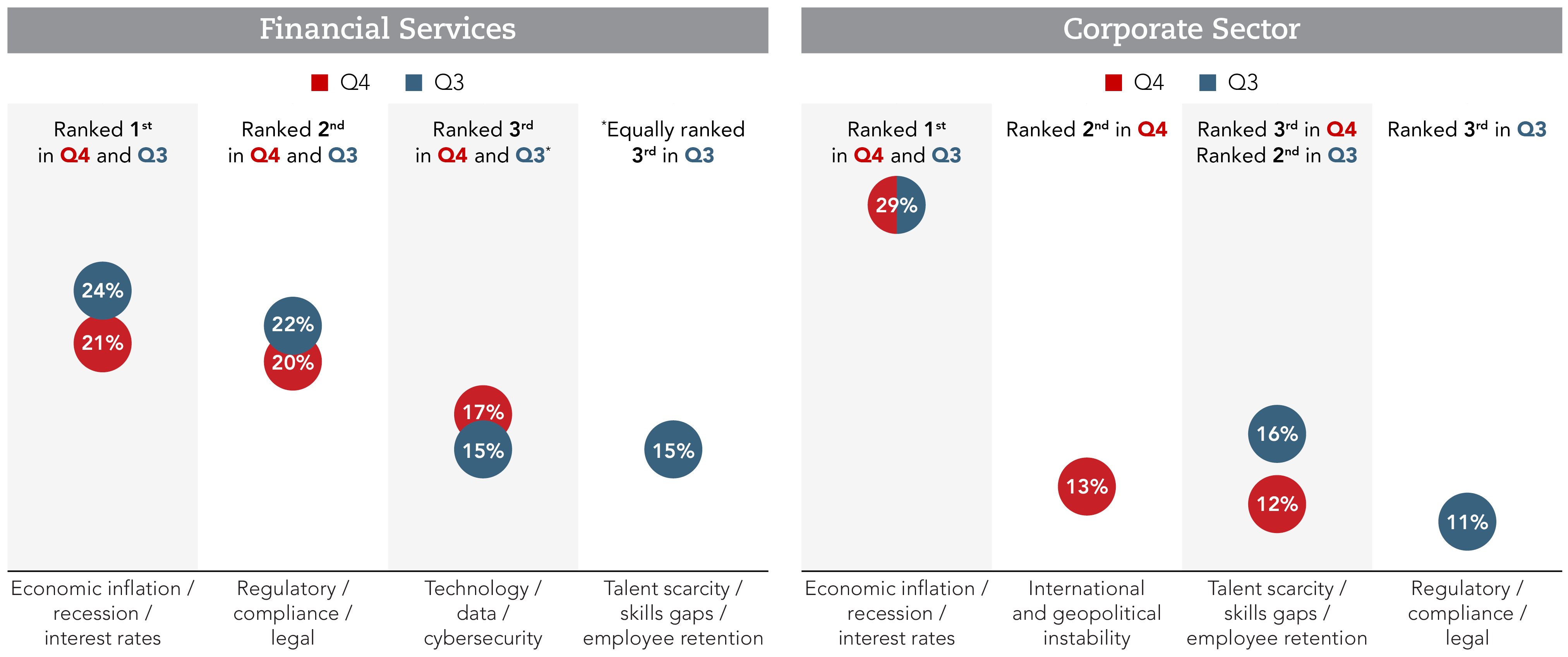

Data from our quarterly Global Risks Survey also shows the risk priorities of financial services versus non-financial corporates.

Underestimated risks

Most ACCA members in the banking industry referred to the unprecedented number of national elections taking place around the world as the most ‘underestimated risks’ for 2024.

Through our open-ended questions, we found that geopolitical risks typically concern financial services respondents more through the ‘technology, data and cybersecurity’ lens, while those working at non-financial corporates see such issues as ‘business-critical’ threats ranging from supply chain disruptions to customer service and reputational hazards, including those related to the integrity of their sustainability reporting.

Respondents from both sectors continue to show an increasing lack of confidence in leaders being able to navigate ‘material’ risks.

Our engagement with ACCA members working in various roles across the three lines at banks also reveals how understanding risk is now both a personal and organisational imperative. Leaders who see how risk management enables good things to happen, rather than just ensuring bad things do not, are more able to drive risk cultures that get their organisations where they want to be.

We heard how participation in essential shared interests, such as KPIs, makes individuals feel safer and more involved in matters that affect everyone, confirming our call to action that says incorporating risk and ethical matters into workplace conversations is the secret sauce of an effective risk culture.

Conduct and culture

ACCA members who work in banking spoke candidly about compliance challenges when it comes to conduct and culture. We found that while more dialogue is needed between banks and their regulators, there is not a lack of willingness, but rather a complexity of an area that we see fast becoming recognised as a ‘must tackle’ for successful risk cultures everywhere – behavioural science.

While we continue to hear more ACCA members saying it makes sense to focus on the behaviours behind the risks because behaviour is something we can measure, monitor and strengthen, the angles or driving forces vary greatly across firms and jurisdictions.

Additionally, this report discusses in detail how the dynamics of risk are more about human behaviour than mathematical models or process design flaws.

It also includes 10 action points for banks, highlighting how stronger partnerships between risk, support units and accounting functions can make a profound difference. These are aimed at helping accountancy and risk leaders recognise the cultural and governance issues that make organisations vulnerable to change and uncertainty. As banks are in the business of taking on risk, it's crucial to address these blind spots before another crisis arises.

Whistleblowing

In the report’s closing remarks, Pav Gill, the Wirecard whistleblower and CEO and founder of Confide, emphasises whistleblowing as a powerful pillar of resilience. In his message to the accountancy profession, he said: ‘Be comfortable in the knowledge that diligent work leads to peaceful nights without concerns about negligence or oversight issues. Remember the intrinsic motivation behind choosing this profession, and elevate your pride in contributing to a transparent and ethical environment.’

Policy and insights report

Risk cultures in banking

"Trusted information is crucial for building resilience and prudential risk taking, and throughout this report we discuss how accountancy professionals can serve as risk culture super-networkers, aiding teams in making informed decisions, and sharing knowledge within and outside the firm."

Rachael Johnson, ACCA's head of risk management and corporate governance, Policy and Insights