This article covers the often-examinable topics within items D1(d), D2(a), (c) and (r), and D3(e) of the syllabus.

The export value added tax (VAT) calculation is often a difficult topic as there are a number of steps to be followed to arrive at the correct VAT amount for export sales.

Documentary confirmation of export sales for application of 0% VAT rate

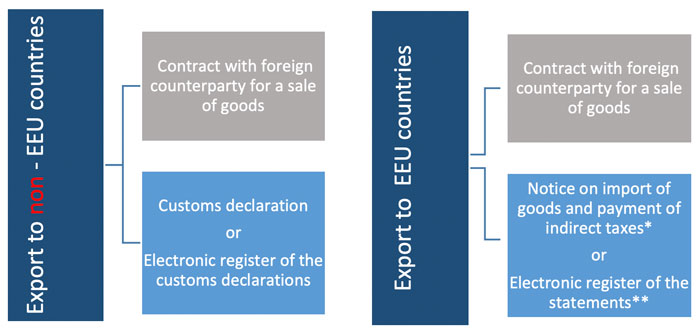

The 0% VAT rate on export sales is a “preferential rate”. To apply the rate, a taxpayer needs to submit a special documentary package to the tax authorities. The documentary package for confirmation of export sales differs for export to the Eurasian Economic Union (EEU) countries and export to non-EEU countries:

* No customs declarations/register for EEU export sales, as there is no customs within the EEU.

These are the requirements for the documents in the special documentary package:

- A sales contract should be concluded with a foreign customer and should be duly executed. Applicable to both EEU and non - EEU export

- A customs declaration should have customs marks – ie export clearance mark and customs confirmation that goods crossed the border of the Russian Federation. Applicable to non – EEU export only.

- The tax authority of the EEU country, to which the goods were exported, should “sign” the Notice on Import of goods and payment of indirect taxes. Applicable to EEU export only.

This is the complete list of the confirming documents, so the tax authorities have no right to ask for any additional documents to confirm the 0% VAT rate for export sales on filing of the VAT return.

If, during a tax audit of the VAT return, the tax authorities find mistakes or discrepancies in documents provided, additional documents and information could be requested – eg payment documents, transportation documents (waybills), and other documents.

The time period for submission of the VAT return and documentary package to confirm 0% VAT rate is:

- For exports to an EEU country - within 180 days from the date when goods have been shipped for export by the seller.

- For export outside of EEU - within 180 days from the date when goods have been cleared for export by the customs authorities.

In both of the above mentioned cases the calculation of 180 days starts on shipping/customs clearance date (including this date).

Thus, the VAT tax base for export sales and VAT at 0% rate (confirmed export) usually are declared in a VAT return for the period when a taxpayer manages to obtain the full and correct documentary package confirming the export sales.

Accounting for export sales in a foreign currency

If export sales are to be paid in a foreign currency, the VAT tax base in rubles (RR) is calculated at the exchange rate on the date of the actual export shipment, regardless of the payment terms (ie the same approach for pre- or post- paid export sales) and status of confirmation of VAT 0% rate.

Please note, that the “shipment date” for the purposes of the VAT tax base calculation means the date when:

i. Goods are dispatched from a seller, or

ii. Property right is transferred to a purchaser (whichever is earlier),

not the date of the goods’ customs clearance.

Currency exchange differences on export sales (if any) do not influence the VAT tax base calculation.

EXAMPLE 1

All data relates to the current year, unless stated otherwise.

OOO Fantasy has the signed sales contract with a German company LLC Move, dated 1 June and made an export shipment of auto parts to LLC Move for 15,000 EUR on 29 June, which were cleared by Customs on 20 July.

The customs declaration with clearance mark and confirmation of movement of the goods across the border was received on 5 January of the next year.

Exchange rates RR/EUR (notional)

29 June – 80

20 July – 82

Required:

Explain when and why OOO Fantasy has the right to declare 0 % VAT for the export sale and calculate the VAT tax base for the respective period.

Answer

1. Period of VAT declaration for the export sale

Output export VAT at 0% rate could be declared in a VAT return for Q1, as:

- 180 days term for obtaining the supporting documentary package starts 20 July and expires 15 January 2021, as the goods were exported to Germany, a non-EEU country, and

- OOO Fantasy obtained the necessary confirmation documents (valid sales contract and customs declaration with obligatory marks; no other documents are necessary) on 5 January.

2. VAT tax base calculation (RR) for Q1

| RR | |

| VAT tax base for 0% VAT rate (15,000*80, exchange rate on the shipment date) |

1,200,000 |

Not confirmed export – VAT calculation

There can be cases of “not confirmed export” - when the documentary package is deficient (either not submitted or with mistakes in the documents) and the 180 days term has expired. For such cases a taxpayer needs to submit an amended tax return for the period, when not confirmed export shipments were actually made (past period), applying the standard VAT rate to the not confirmed export sales tax base and paying penalties for the late payment of the VAT.

If, afterwards, the correct document package is obtained, the 0% VAT rate for “finally” confirmed export sales could be claimed, as well as offset of the VAT accrued earlier on export sales at the standard rate. This could be done in a VAT tax return for the period when the document package is obtained, within a limitation term of three years from the quarter end when the export shipment has been made.

The effect of the not confirmed export sale is one of timing. Output VAT at the standard rate is accrued in the quarter in which the shipment is made and is recovered in the quarter when the correct documents are received; provided this is within three years of the export shipment date.

EXAMPLE 2 (not confirmed export sales)

All data relates to the current year, unless stated otherwise.

OOO Fashion has a signed sales contract with LLC Market, a Belarus company, dated 25 June. OOO Fashion made an export shipment of a batch of women’s bags to LLC Market on 30 June.

OOO Fashion received the Notice on import of goods and payment of indirect taxes on 30 January of the next year.

OOO Fashion received a 50% prepayment on 25 June and the final 50% payment for the exported goods on 7 July; a total of 30,000 EUR.

Exchange rates RR/EUR (notional)

25 June 2020 – 79

30 June 2020 – 80

7 July 2020 – 82

31 March 2021 – 91

Required:

Calculate the VAT tax base and VAT on the export, clearly explaining timing and the reasons for the calculations.

Answer

1. Amended tax return for the not confirmed export

Amended tax return for Q2 (the period of the export shipment) should be submitted as supporting documents were not obtained within 180 days from the date of the export shipment (215 days passed from 1 July until 30 January of the next year).

| RR | |

Q2 (amended tax return) VAT tax base for 20% VAT rate |

2,400,000 |

VAT at 20% |

480,000 |

2. Tax return for the period, when the export is confirmed

As the full documentary package is available in January of the next year (ie in Q1 of the next year) the following export VAT could be included in the tax return:

| RR | |

Q1 of the next year (initial tax return) Output VAT VAT tax base for 0% VAT rate |

2,400,000 |

VAT at 0% |

0 |

Input VAT Input VAT for recovery |

480,000 |

Recovery of input VAT on export sales

General recovery

Export of goods is a VATable activity for the purpose of offsetting input VAT on related purchases. For exported goods, which are not raw-materials and similar commodities, there are no special rules for recovery of input VAT related to export sales. Such offset is done in the general way. Also, there is no obligation to amend the input VAT, related to export sales, even if application of the 0% VAT on the sales is not confirmed.

The standard terms to offset the input VAT where:

i. Purchased goods are accounted for,

ii. Purchased goods are intended for use in VATable activities, and

iii. There is a correct VAT invoice for the purchased goods.

Please note, that if a VAT invoice related to, for example, Q1 purchases was received by a taxpayer not later than 25 April (ie by the due date for tax return submission), the related VAT still could be recovered in the Q1 VAT return. Also, the standard limitation time period when input VAT could be claimed for recovery, is three years from the date when the goods were purchased (provided that the other conditions for the recovery are met).

EXAMPLE 3

All data relates to the current year, unless stated otherwise.

Adding to the scenario in example 1 – OOO Fantasy purchased the following items, related to the goods sold on 29 June (all amounts are VAT inclusive):

i. Auto parts costing 660,000 RR purchased in January, with the respective VAT invoice dated and received by OOO Fantasy in January, and

ii. Packaging for the goods costing 48,000 RR purchased in June, with the respective VAT invoice dated June and received by OOO Fantasy on 23 July.

Required:

Calculate the input VAT for export sales, clearly explaining timing and the reasons for the calculation

Answer

| RR | |

| Input VAT for Q1 (at standard VAT rate of 20% (660,000*20%/120%), as general offset conditions are met) |

110,000 |

Input VAT for Q2 |

8,000 |

Recovery on export of raw-materials and similar commodities

There are special rules for the offset of input VAT for the export of raw-materials and similar commodities (eg coal, lumber, precious metals), namely:

- Input VAT could be recovered on the date of calculation of the export VAT tax base – ie on the last day of a tax period when the correct documentary package is available or at the date of the export shipment for not confirmed export,

In addition, if a taxpayer both exports and sells commodities to Russian customers, and incurs input VAT on operating expenses relevant to both the export and the domestic sales, such input VAT should be allocated between export and domestic sales and claimed for offset under each respective rules. Allocation could be done based on respective revenue amounts (the allocation approach should be stipulated by the tax accounting policy).

EXAMPLE 4

All data relates to the current year, unless stated otherwise.

OOO Forest made the following three shipments of industrial wood (a commodity) in Q1:

OOO Forest has a signed sales contract with LLC Furniture a Belarus company, dated 12 January (all amounts are VAT exclusive, unless stated otherwise).

i. An export shipment of 300 m3 of industrial wood to LLC Furniture on 25 January, for 1,200,000 RR.

ii. An export shipment of 450m3 of industrial wood to LLC Furniture on 28 February, for 2,290,000 RR.

OOO Forest received the Notice on import of goods and payment of indirect taxes for the January export shipment on 10 July and for the February export shipment on 28 October.

iii. A shipment of 560m3 of industrial wood to a Russian company OOO Case on 28 February, for 3,670,000 RR.

Related expenses (wood and operating costs)

The total 1310 m3 (300+450+560) of wood was purchased by OOO Forest on 10 January for 4,200,000 RR (VAT inclusive) with the respective VAT invoice dated and received by OOO Forest in January 2021.

In Q1 input VAT for operating expenses related to the trading activities of OOO Forest was 360,000 RR, with correct VAT invoices available. The accounting policy of OOO Forest stipulates allocation of input VAT on these operating expenses between export and domestic sales of commodities according to their respective revenues.

OOO Forest did not have any other transactions in Q1.

Required:

Calculate output and input VAT for export sales, clearly explaining timing and the reasons for the calculation

Answer:

| RR | ||

| 1. Allocation of input VAT on operating expenses to export sales: | ||

| Input VAT allocated to first export shipment (1,200,000/(1,200,000+2,290,000+3,670,000)*360,000) | 60,335 | |

| Input VAT allocated to second export shipment (2,290,000)/(1,200,000+2,290,000+3,670,000)*360,000) | 115,140 | |

| 2. Allocation of input VAT on purchase of wood to export sales: | ||

| Input VAT allocated to first export shipment (300/1310*4,200,000*20%/120%) | 160,305 | |

| Input VAT allocated to second export shipment (450/1310*4,200,000*20%/120%) | 240,458 | |

| 3. Calculation of VAT on export sales | ||

| Q1 (amended tax return) | ||

| Output VAT on not confirmed second export shipment (of 450 m3) ((2,290,000*20%), 242 days passed between the date of the shipment and the date of gathering of all documents to confirm 0% VAT rate) | 458,000 | |

| Input VAT on operating expenses and wood purchases for the not confirmed second export shipment (115,140+240,458) | 355,598 | |

| Q3 (initial tax return) | ||

| Output VAT on confirmed first export shipment (of 300 m3) ((1,200,000*0%), 167 days passed between the date of the shipment and the date of gathering of all documents to confirm 0% VAT rate in Q3) | 0 | |

| Input VAT on operating expenses and wood purchases for the confirmed first export shipment (60,335+160,305) | 220,640 | |

| Q4 (initial tax return) | ||

| Output VAT on confirmed second export shipment ((2,290,000*0%), as full documentary package is available in October | 0 | |

Input VAT on confirmed second export shipment

| 458,000 |

Written by a member of the TX-RUS examining team