Part 1 of 4

This is the Finance Act 2021 version of this article. It is relevant for candidates sitting the ATX-UK exam in the period 1 June 2022 to 31 March 2023. Candidates sitting ATX-UK after 31 March 2023 should refer to the Finance Act 2022 version of this article (to be published on the ACCA website in 2023).

This is not an introductory article: it is relevant to students coming to the end of their studies and finalising their preparations to sit the exam. It is intended to be read proactively – ie statements made should be confirmed as true by reference to the reader’s understanding of the rules or to a relevant study text. This approach will enable situations to be analysed from first principles rather than by reference to a rigid set of memorised planning points.

Liability to tax in the UK depends on an individual’s residence and domicile status, together with the location of their assets and the sources of their income. It is a tricky area and can be confusing. This article aims to clear up any confusion you may have.

This article starts with some basic rules, an understanding of which will enable you to identify the particular areas of tax affected by an individual coming to, or leaving, the UK. It then goes on to review those areas in some detail, and provides a clear set of questions to ask in order to determine an individual’s liability to UK taxes. Finally, it deals briefly with the impact of double tax relief and treaties.

Some basic rules

Generally, the UK tax position of an individual who is resident and domiciled in the UK is as follows:

- Income tax (IT) on worldwide income.

- Capital gains tax (CGT) on worldwide assets.

- Inheritance tax (IHT) on worldwide assets.

Similarly, the UK tax position of an individual with no links to the UK (i.e. someone who is not resident and not domiciled in the UK) is as follows:

- IT on UK source income only.

- No CGT (in most circumstances – but see Part 4 for exceptions).

- IHT on UK assets only.

Read the above points carefully, think about them, and recognise that they result in the following:

- UK source income is always subject to UK IT, regardless of the status of the individual.

- There is no UK CGT, even on (most) UK assets, where the individual is based outside of the UK (but see Part 4 for exceptions).

- UK assets are always subject to UK IHT, regardless of the status of the individual.

UK source income consists of: income in respect of UK assets, employment income in respect of duties performed in the UK, and trading income in respect of trades carried on in the UK.

UK assets include land, buildings and chattels in the UK, cash in UK bank accounts, and UK registered securities.

Completing the picture

The rules set out above raise three fundamental questions:

- Overseas income: In what circumstances does overseas income become subject to UK IT?

- Liability to UK CGT: In what circumstances are gains on UK and overseas assets subject to UK CGT?

- Liability to UK IHT on overseas assets: In what circumstances do overseas assets become subject to UK IHT?

This article identifies the order in which the key factors of residence and domicile should be considered when answering these questions. Overviews of the rules used to determine an individual’s residence and domicile status are set out below.

Residence

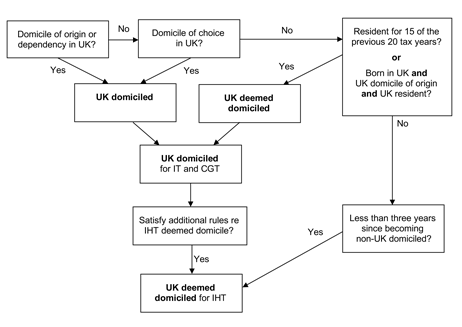

The rules governing residence are very detailed and depend on the time spent in the UK and the circumstances of the individual concerned.

Figure 1 – Determination of residence status

The table indicating the number of required UK ties by reference to the number of days in the UK is provided in the exam.

The split year treatment

Normally an individual is resident or not resident for the whole of a tax year. However, in certain circumstances, the tax year of arrival and departure can be split. Under the split year treatment, the year is split into a UK part and an overseas part. The individual is taxed as a UK resident for the UK part and as a non-UK resident for the overseas part. This applies to both income tax and capital gains tax.

Domicile

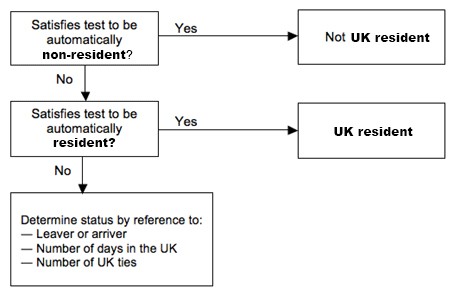

An individual’s domicile status is relevant for IT, CGT and IHT. Individuals who are not UK domiciled may be deemed domiciled in the UK for tax purposes.

Coming to the UK

A non-UK domiciled individual who comes to the UK will become UK domiciled if:

- all links with the former country of domicile are cut, and

- the individual intends to remain in the UK permanently.

Leaving the UK

An individual who has left the UK will cease to be UK domiciled if:

- all links with the UK have been cut, and

- the individual intends to remain in the new country permanently.

Deemed domicile

There are two forms of deemed domicile status: one applies to IT and CGT and the other applies to IHT.

Figure 2 – Determination of domicile status

Click to enlarge

Conclusion

In order to be able to handle questions on international matters in the exam you will need to have done some methodical learning. In particular, you should be confident in your knowledge of the basic rules set out above in respect of residence and domicile.

Written by a member of the ATX-UK examining team

The comments in this article do not amount to advice on a particular matter and should not be taken as such. No reliance should be placed on the content of this article as the basis of any decision. The authors and the ACCA expressly disclaim all liability to any person in respect of any indirect, incidental, consequential or other damages relating to the use of this article.