Part 3 of 4

This is the Finance Act 2015 version of this article. It is relevant for candidates sitting the P6 (UK) exam in the period 1 September 2016 to 31 March 2017. Candidates sitting P6 (UK) after 31 March 2017 should refer to the Finance Act 2016 version of this article (to be published on the ACCA website in 2017).

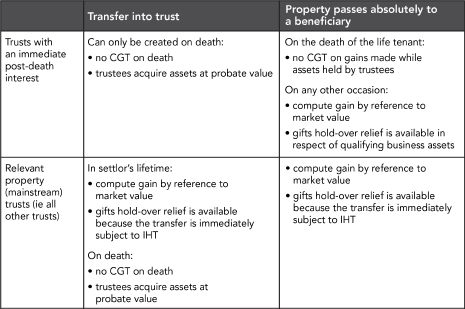

So far in this article we have looked at the reasons why it may be beneficial to use a trust, the different types of trust and the inheritance tax (IHT) implications of transferring assets to and from a trust. In this part we are now going to look at capital gains tax (CGT) and an example illustrating the IHT and CGT implications of creating a trust with an immediate post-death interest via a will.

Capital gains tax

As far as CGT is concerned it should be remembered that there is no CGT on death. Where the transfer to or from the trust has not arisen on death, it is necessary to consider whether the assets are chargeable or exempt. If they are chargeable, and a gain has arisen, the availability of reliefs, particularly gifts hold-over relief, should also be considered.

The CGT implications of transferring assets to a trust, and of property passing absolutely from a trust to a beneficiary, are summarised in Table 2 below. These rules apply to transfers made on or after 22 March 2006. The rules that applied prior to that date are not examinable.

Table 2 shows that:

- there can be no chargeable gain on the creation of a trust with an immediate post-death interest as it can only be created on death

- due to the availability of gifts hold-over relief, no CGT need be paid on the transfer of any assets to or from a relevant property trust.

Table 2: Capital gains tax and trusts

Download larger version of Table 2

Example 1

Alfred

Alfred is married with three children. His main assets are a valuable art collection and a number of investment properties. Alfred is writing his will and wants to provide for his wife, Molly, whilst ensuring that the capital value of his estate is preserved for his children.

Alfred could establish a trust with an immediate post-death interest via his will. Molly would be the life tenant and would have the right to use the trust assets and receive any income during her lifetime. On her death the assets would pass to the children.

Alfred would need to be advised that on the transfer of the assets to the trustees:

- there will be no CGT as the trust will be created on his death

- there will be no IHT, as he will be regarded as having left his estate to Molly such that the spouse exemption will apply.

Whilst the assets are in the trust:

- the trustees will be subject to income tax and CGT on the income and gains arising in respect of the trust assets; Molly will also be taxed on the income but will receive a credit for the tax paid by the trustees

- there will be no 10-year charge.

On the death of Molly and the transfer of the assets to the children:

- there will be no CGT on the gains made whilst the assets have been within the trust, because the assets are transferred as a consequence of a death

- the trust property will be included in Molly’s death estate for the purposes of IHT and the IHT thereon will be paid out of the trust’s assets.

Conclusion

You need to be completely clear in your mind as to the rules set out in Table 2 (and Table 1 from Part 2). Gifts hold-over relief is particularly important here, as it is available, regardless of the nature of the assets disposed of, whenever a transfer is immediately subject to IHT.

Written by a member of the P6 examining team

The comments in this article do not amount to advice on a particular matter and should not be taken as such. No reliance should be placed on the content of this article as the basis of any decision. The authors and the ACCA expressly disclaim all liability to any person in respect of any indirect, incidental, consequential or other damages relating to the use of this article.