Following the revisions to IFRS 3, Business Combinations, in January 2008, there are now two ways of measuring the goodwill that arises on the acquisition of a subsidiary and each has a slightly different impairment process.

This article discusses and shows both ways of measuring goodwill following the acquisition of a subsidiary, and how each measurement of goodwill is subject to an annual impairment review.

How to calculate goodwill

The established measurement of goodwill on the acquisition of a subsidiary is the excess of the fair value of the consideration given by the parent over the parent’s share of the fair value of the net assets acquired. This method can be referred to as the proportionate (or partial goodwill) method. It determines only the goodwill that is attributable to the parent company.

The more recent method, following the revision to IFRS 3, of measuring goodwill on the acquisition of the subsidiary is to compare the fair value of the whole of the subsidiary (as represented by the fair value of the consideration given by the parent plus the fair value of the non-controlling interest) with 100% of the fair value of the net assets of the subsidiary acquired. This method can be referred to as the gross or full goodwill method. It determines the goodwill that relates to the whole of the subsidiary, ie goodwill that is both attributable to the parent’s interest and the non-controlling interest (NCI).

You should note that either method is acceptable and therefore for the DipIFR exam you need to be able to apply both approaches. You will be given a clear indication of which method the examiner wishes you to use and the appropriate information to undertake the correct calculation.

Consider calculating goodwill

Borough acquires an 80% interest in the equity shares of High for consideration of $500. The fair value of the net assets of High at that date is $400. The fair value of the NCI at that date (ie the fair value of High’s shares not acquired by Borough) is $100.

Required

1. Calculate the goodwill arising on the acquisition of High on a proportionate basis (partial method).

2. Calculate the gross goodwill arising on the acquisition of High, ie using the fair value of the NCI (full method).

Solution

1. The proportionate goodwill arising is calculated by matching the consideration that the parent has given, with the interest that the parent acquires in the net assets of the subsidiary, to give the goodwill of the subsidiary that is attributable to the parent.

| Parent’s cost of investment at the fair value of consideration given | $500 | ||

| Less the parent’s share of the fair value of the net assets of the subsidiary acquired | (80% x $400) | ($320) | |

| Goodwill attributable to the parent | $180 |

2. The gross goodwill arising is calculated by matching the fair value of the whole business with the whole fair value of the net assets of the subsidiary to give the whole goodwill of the subsidiary, attributable to both the parent and to the NCI.

| Parent’s cost of investment at the fair value of consideration given | $500 | ||

| Fair value of the NCI | $100 | ||

| Less the fair value of the net assets of the subsidiary acquired | (100% x $400) | ($400) | |

| Gross goodwill | $200 |

Given a gross goodwill of $200 and a goodwill attributable to the parent of $180, the goodwill attributable to the NCI is the difference of $20.

In these examples, goodwill is said to be a premium arising on acquisition. Such goodwill is accounted for as an intangible asset in the group accounts, and as we shall see later, be subject to an annual impairment review.

In the event that there is a bargain purchase, ie ‘negative’ goodwill arises. This will occur when the aggregate of the fair values of the separable net assets acquired exceed the consideration paid for them. IFRS 3 requires this is accounted for as a gain and immediately recognised in the group statement of profit or loss on the acquisition date. In subsequent years this will be an adjustment to the group retained earnings.

Basic principles of impairment

An asset is impaired when its carrying amount exceeds the recoverable amount. The recoverable amount is, in turn, defined as the higher of the fair value less cost to sell and the value in use; where the value in use is the present value of the future cash flows.

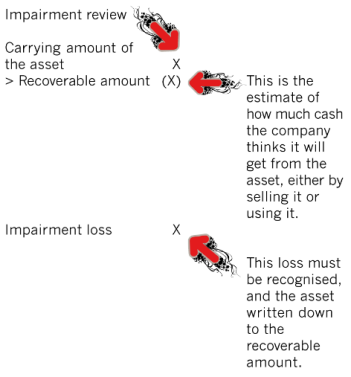

An impairment review calculation looks like this.

This is the net book value, ie the figure that the asset is currently recorded at in the accounts.

Consider an impairment review

A company has an asset that has a carrying amount of $800. The asset has not been revalued. The asset is subject to an impairment review. If the asset was sold then it would sell for $610 and there would be associated selling costs of $10. (The fair value less costs to sell of the asset is therefore $600.) The estimate of the present value of the future cash flows to be generated by the asset if it were kept is $750. (This is the value in use of the asset.)

Required

Determine the outcome of the impairment review.

Solution

An asset is impaired when its carrying amount exceeds the recoverable amount, where the recoverable amount is the higher of the fair value less costs to sell and the value in use. In this case, with a fair value less cost to sell of only $600 and a value in use of $750 it makes commercial sense to minimise losses, and follows the requirements of IAS 36® Impairment of Assets, that the recoverable amount will be the higher of the two, ie $750.

Impairment review

| Carrying value of the asset | $800 | |

| Recoverable amount | ($750) | |

| Impairment loss | $50 |

The impairment loss must be recorded so that the asset is written down. There is no accounting policy or choice about this. In the event that the recoverable amount had exceeded the carrying amount then there would be no impairment loss to recognise and as there is no such thing as an impairment gain, no accounting entry would arise.

As the asset has never been revalued, the loss has to be charged to profit or loss. Impairment losses are non-cash expenses, like depreciation, so in the statement of cash flows they will be added back when reconciling profit before tax to cash generated from operating activities (indirect method) or removed as a non-cash expense to arrive at the cash outflows under the direct method. This is the same treatment as other non-cash expenses like depreciation and amortisation.

Assets are generally subject to an impairment review only if there are indicators of impairment. IAS 36 lists examples of circumstances that would trigger an impairment review.

External sources

- market value declines

- negative changes in technology, markets, economy, or laws

- increases in market interest rates

- company share price is below book value

Internal sources

- obsolescence or physical damage

- asset is part of a restructuring or held for disposal

- worse economic performance than expected

However certain intangible assets must be assessed for impairment annually, irrespective of whether there are indications of impairment. These are:

- assets with an indefinite useful life

- assets not yet available for use

- goodwill acquired in a business combination

Goodwill and impairment

The asset of goodwill does not exist in a vacuum; rather, it arises in the group accounts because it is not separable from the net assets of the subsidiary that have just been acquired.

The impairment review of goodwill therefore takes place at the level of a cash-generating unit, that is to say a collection of assets that together create a cash flow independent from the cash flows from other assets. The cash-generating unit will normally be assumed to be the subsidiary. In this way, when conducting the impairment review, the carrying amount will be that of the net assets and the goodwill of the subsidiary compared with the recoverable amount of the subsidiary.

When looking to assign the impairment loss to particular assets within the cash generating unit, unless there is an asset that is specifically impaired, it is goodwill that is written off first, with any further balance being assigned on a pro rata basis to the other assets.

The goodwill arising on the acquisition of a subsidiary is subject to an annual impairment review. This requirement ensures that the asset of goodwill is not being overstated in the group accounts. Goodwill is an asset that cannot be revalued so any impairment loss will automatically be charged against profit or loss. Goodwill is not deemed to be systematically consumed or worn out thus there is no requirement for a systematic amortisation unlike most intangible assets. An impairment loss allocated against goodwill cannot be reversed in subsequent accounting periods.

Proportionate goodwill and the impairment review

When goodwill has been calculated on a proportionate basis then for the purposes of conducting the impairment review it is necessary to gross up goodwill so that in the impairment review goodwill will include the previously unrecognised 'notional goodwill' attributable to the NCI.

Any impairment loss that arises is first allocated against the total of recognised and unrecognised goodwill in the normal proportions that the parent and NCI share profits and losses.

Any amounts written off against the notional goodwill will not affect the consolidated financial statements and NCI. Any amounts written off against the recognised goodwill will be attributable to the parent only, without affecting the NCI.

If the total amount of impairment loss exceeds the amount allocated against recognised and notional goodwill, the excess will be allocated against the other assets on a pro rata basis. This further loss will be shared between the parent and the NCI in the normal proportion that they share profits and losses.

An example should make this rule clearer.

Consider an impairment review of proportionate goodwill

At the year-end, an impairment review is being conducted on a 60%-owned subsidiary. At the date of the impairment review the carrying amount of the subsidiary’s net assets were $250 and the goodwill attributable to the parent $300 and the recoverable amount of the subsidiary $700.

Required

Determine the outcome of the impairment review.

Solution

In conducting the impairment review of proportionate goodwill, it is first necessary to gross it up.

| Proportionate goodwill | Grossed up | Goodwill including the notional unrecognised NCI |

| $300 x | 100/60 = | $500 |

Now, for the purposes of the impairment review, the goodwill of $500 together with the net assets of $250 form the carrying value of the cash-generating unit.

Impairment review

| Carrying amount | ||

|---|---|---|

| Net assets | $250 | |

| Goodwill | $500 | |

| $750 | ||

| Recoverable amount | ($700) | |

| Impairment loss | $50 |

The impairment loss does not exceed the total of the recognised and unrecognised goodwill so therefore it is only goodwill that has been impaired. The other assets are not impaired. As proportionate goodwill is only attributable to the parent, the impairment loss will not impact NCI.

Only the parent’s share of the goodwill impairment loss will actually be recorded, ie 60% x $50 = $30.

The impairment loss will be applied to write down the goodwill, so that the intangible asset of goodwill that will appear on the group statement of financial position will be $270 ($300 – $30).

In the group statement of financial position, the retained earnings will be reduced $30. There is no impact on the NCI.

In the group statement of profit or loss, the impairment loss of $30 will be charged as an extra operating expense. There is no impact on the NCI.

Gross goodwill and the impairment review

Where goodwill has been calculated gross (full method), then all the parts in the impairment review process are already consistently recorded in full. Any impairment loss (whether it relates to the gross goodwill or the other assets) will be allocated between the parent and the NCI in the normal proportion that they share profits and losses.

Consider an impairment review of gross goodwill

At the year-end, an impairment review is being conducted on an 80%-owned subsidiary. At the date of the impairment review the carrying amount of the net assets were $400 and the gross goodwill $300 (of which $40 is attributable to the NCI) and the recoverable amount of the subsidiary $500.

Required

Determine the outcome of the impairment review.

Solution

The impairment review of goodwill is really the impairment review of the net asset’s subsidiary and its goodwill, as together they form a cash generating unit for which it is possible to ascertain a recoverable amount.

Impairment review

| Carrying value | |

|---|---|

| Net assets | $400 |

| Goodwill | $300 |

| $700 | |

| Recoverable amount | $500 |

| Impairment loss | $200 |

The impairment loss will be applied to write down the goodwill, so that the intangible asset of goodwill that will appear on the group statement of financial position, will be $100 ($300 – $200).

In the equity of the group statement of financial position, the retained earnings will be reduced by the parent’s share of the impairment loss on the gross goodwill, ie $160 (80% x $200) and the NCI reduced by the NCI’s share, ie $40 (20% x $200).

In the statement of profit or loss, the impairment loss of $200 will be charged as an extra operating expense. As the impairment loss relates to the gross goodwill of the subsidiary, so it will reduce the NCI in the subsidiary’s profit for the year by $40 (20% x $200).

Observation

In passing, you may wish to note an apparent anomaly with regards to the accounting treatment of gross goodwill and the impairment losses attributable to the NCI. The goodwill attributable to the NCI in this example is stated as $40. This means that goodwill is $40 greater than it would have been if it had been measured on a proportionate basis; likewise, the NCI is also $40 greater for having been measured at fair value at acquisition.

The split of the gross goodwill between what is attributable to the parent and what is attributable to the NCI is determined by the relative values of the NCI at acquisition to the parent’s cost of investment. However, when it comes to the allocation of impairment losses attributable to the write off of goodwill then these losses are shared in the normal proportions that the parent and the NCI share profits and losses, ie in this case 80%/20%.

This explains the strange phenomena that while the NCI are attributed with only $40 out of the $300 of the gross goodwill, when the gross goodwill was impaired by $200 (ie two thirds of its value), the NCI are charged $40 of that loss, representing all of the goodwill attributable to the NCI.

Article updated by DipIFR examining team