Although the trade payables account in the general ledger provides a snapshot of the total amount owed to all credit suppliers, it is vital that separate records of transactions with each individual supplier are also maintained and that these are accurate. In this article, we will discuss the reasons for maintaining accurate records of transactions with individual suppliers and outline how reconciliations can be used to identify errors in accounting records.

Why are individual supplier accounts needed?

It is important for an entity to maintain good relationships with its suppliers, otherwise those suppliers may not be willing to provide favourable credit terms or may choose not to provide any more goods or services at all. For example, this may happen when a customer has a history of non-payment within an agreed time limit. Conversely, regular customers with good credit history may be more likely to receive preferential treatment such as trade discounts and longer credit terms.

Without maintaining accurate supplier account records, it would be very easy to miss payment deadlines or forget about purchase invoices altogether. Although the trade payables balance in the general ledger provides a snapshot of the total amount owed to all credit suppliers, it is not helpful when determining how much is owed to individual suppliers. Poorly-maintained supplier account records also make errors harder to spot – both errors in the customer’s own accounting records and those of its supplier.

How can an entity verify the amounts owed to suppliers?

Where sales are regularly made on credit, it is good practice for an entity to send customer account statements to its credit customers – this may be referred to as a ‘statement of account’. This is a document which covers a specific period and shows the customer how much they owed at the start of that period, the various transactions which have affected this amount (eg further invoices, credit notes and payments) and shows the current balance on the customer’s account at the end of the period.

From the customer’s perspective, the document they receive may be referred to by them as a ‘supplier statement’. It is an important source document which can be used to reconcile and verify data in the accounting system regarding that supplier.

It may be possible for an entity to generate its own ‘supplier statement’ from its own accounting records which is then distributed to its suppliers to confirm balances owed but this is not as common as producing customer account statements. For the purposes of the FA1, FA2 and FFA exams, we will assume that a ‘supplier statement’ is the document received from a supplier (ie the supplier’s ‘customer account statement’).

Why might there be differences between the balance in the accounting records and the supplier statement?

There are various reasons why an entity’s accounting records may show a different amount owed to a supplier than might be shown on the supplier statement. These include:

- A payment made by the customer which has not been received by the supplier (ie a timing difference)

- Allocating a purchase invoice against the wrong supplier

- Credit notes not processed

- Debit notes not processed

- Discounts not accounted for correctly

- Transposition errors when entering information from the purchase invoice into the accounting system

Illustrative example 1

Amelia’s accounting records show an amount owing to Charles of $650 at 30 September 20X5.

On 5 October 20X5, Amelia received a supplier statement from Charles which indicated that the total owed at 30 September 20X5 was $750.

Which of the following could explain the reason for the difference?

A Amelia incorrectly entered a purchase invoice of $300 into her accounting system as $400

B Amelia sent a cheque for $100 on 30 September 20X5 to fully settle an outstanding invoice but Charles has not yet received it

C Charles sent a credit note to Amelia for $100 on 30 September 20X5 but Amelia has not yet received it

D Amelia attempted to send a debit note to Charles for $100 on 30 September 20X5, formally requesting a reduction in an amount due to him. Amelia accidentally recorded this as a purchase invoice. Charles has not received the invoice yet.

The correct answer is:

B Amelia sent a cheque for $100 on 30 September 20X5 to fully settle an outstanding invoice but Charles has not yet received it

In her own accounting records, Amelia will have recorded the payment of $100 and reduced the total amount owed to Charles accordingly. Since Charles has not received the cheque, this same $100 is still showing as owed by Amelia. It is not an error but a timing difference. Charles will update his own accounting records once the cheque has been received.

The answer cannot be A or C because both situations would result in the amount owing to Charles being $100 higher in Amelia’s accounting records.

This is also the case with D, although the $100 difference would be explained by Amelia sending a debit note to Charles which he had not yet received, this is not actually the situation here. Instead, Amelia has accidentally processed a purchase invoice rather than a debit note. If this had happened, the balance in Amelia’s accounting records showing as owed to Charles would be $100 higher than the supplier statement received from Charles. As this is not the case, the answer cannot be D.

Illustrative example 2

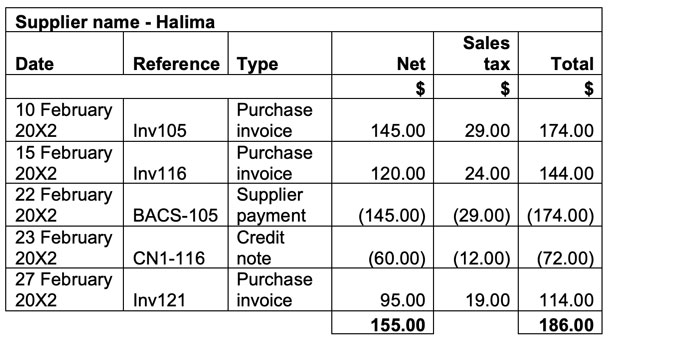

Morag regularly buys goods from Halima and Morag’s accounting records show the following transactions with Halima during the month of February 20X2:

Supplier account

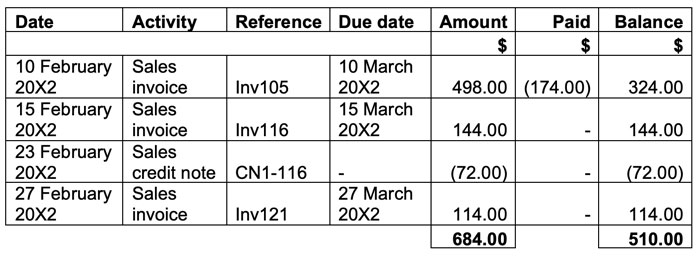

On 7 March 20X2, Morag received a supplier statement from Halima. An extract from this statement has been provided below:

Extract from supplier statement received from Halima

Morag has started a reconciliation between her own accounting records and the supplier statement.

All purchases were subject to sales tax at 20%.

Which of the following statements is correct?

A Morag may have made a transposition error when entering the purchase invoice referenced ‘Inv105’ into her accounting system

B The credit note referenced ‘CN1-116’ must be incorrect as it does not agree to the full value of the sales invoice referenced ‘Inv116’

C In the supplier statement received from Halima, the amounts due should not include sales tax

D According to Morag’s accounting records, she currently owes Halima $510.00

The correct answer is:

A Morag may have made a transposition error when entering the purchase invoice referenced ‘Inv105’ into her accounting system

As there is a difference in both Morag and Halima’s accounting records related to the invoice referenced ‘Inv105’, either Morag or Halima have made an error when processing the invoice. It is possible that Morag made a transposition error by including the purchase invoice at a net amount of $145 and calculating sales tax at 20% on that basis. If the purchase invoice related to a net purchase of $415, then the gross amount due to Halima would be $498 ($415 x 120/100) and would agree to Halima’s supplier statement.

The answer cannot be B as credit notes do not necessarily need to be issued for the full amount of the invoice. For example, although the credit note referenced ‘CN1-116’ only covers half of the amount of the original purchase invoice, it may relate to a batch of goods where only half were damaged.

The answer cannot be C because the amounts due to Halima will include sales tax. Morag will pay the gross amount (ie the amount inclusive of sales tax) to Halima for any goods purchased and Halima will be responsible for paying any sales tax due to the tax authorities.

Finally, the answer cannot be D because the $510 balance showing as due is in Halima’s accounting records. It is likely that this is the correct amount due by Morag (assuming there are no other errors than Inv105) but the supplier statement received does not currently reflect Morag’s accounting records.

Once Morag was able to establish that the reason for the difference between her own accounting records and the supplier statement was due to an error in how she had recorded Inv105, the reconciliation produced by Morag may look like this:

$ |

|

Balance per supplier account |

186 |

Correction for Inv105 (498 – 174) |

324 |

Reconciled balance due |

510 |

Balance per supplier statement |

510 |

Difference |

– |

By producing this reconciliation, Morag can satisfy herself that there should not be any further errors. It is likely that Morag would then prioritise payment of Inv105 so that she did not miss any payment deadlines. If she was already late in settling the invoice, it would be wise to make the payment as soon as possible and to contact Halima to explain the situation.

Summary

Maintaining accurate supplier accounts reduces the risk of errors in the accounts and means that there will be less risk of paying suppliers late or paying the wrong amounts. By performing reconciliations between the accounting records and any supplier statements received, it may be possible to spot errors or discrepancies early so that these can be investigated and discussed with the supplier. Dealing with such discrepancies quickly and professionally is key to maintaining good relationships with suppliers.

Written by a member of the FFA/FA examining team