Part 2 of 4

This is the Finance Act 2020 version of this article. It is relevant for candidates sitting the ATX-UK exam in the period 1 June 2021 to 31 March 2022. Candidates sitting ATX-UK after 31 March 2022 should refer to the Finance Act 2021 version of this article (to be published on the ACCA website in 2022).

In the first part of this article we looked at some basic rules concerning the international aspects of income tax (IT), capital gains tax (CGT) and inheritance tax (IHT) and reviewed residence and domicile status. The remaining parts of this article look at the three personal taxes in more detail together with the remittance basis.

Overseas income

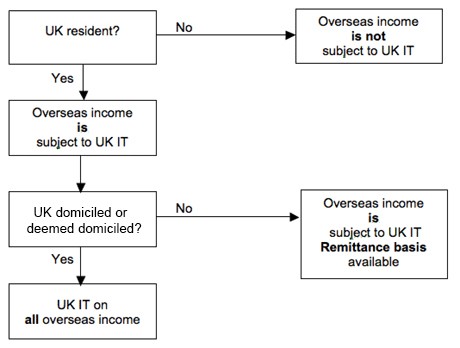

The starting point when considering the taxation of overseas income is the individual’s residence position. Figure 3 sets out an individual’s liability to UK income tax in respect of overseas investment income and trading income.

Figure 3 – UK IT on overseas investment income and trading income

Figure 3 relates to the taxation of overseas investment income and trading income only. It has already been recognised that UK source income is always subject to UK IT regardless of the individual’s tax status. Overseas employment income is considered below.

Note the following:

- Where an individual IS NOT UK RESIDENT, overseas income is not subject to UK IT. There is no need to consider the person’s domicile status or the remittance basis. This is true regardless of whether or not the income is brought into the UK.

- Where an individual IS UK RESIDENT, overseas income is subject to UK IT. The manner in which it is taxed depends on the individual’s domicile status. The remittance basis is available if the individual is not domiciled in the UK.

An overview of the remittance basis is provided in Part 3 of this article.

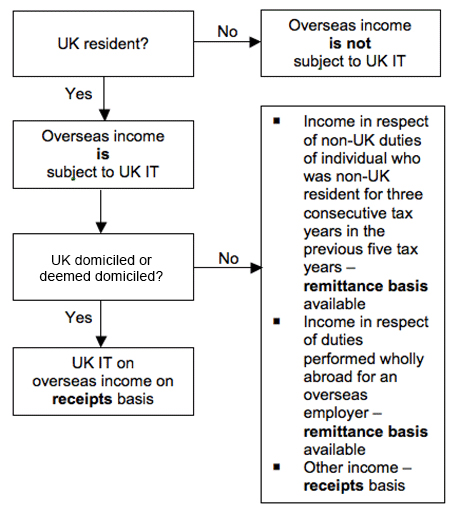

Figure 4 sets out an individual’s liability to UK IT in respect of overseas employment income – ie income in respect of overseas duties.

Figure 4 – UK IT on overseas employment income

Figure 4 relates to the taxation of overseas employment income only and is slightly different from Figure 3. A UK resident but non-UK domiciled individual can only be taxed on the remittance basis in respect of overseas employment income in certain particular circumstances.

The rules set out in Part 3 of this article in respect of the remittance basis apply equally here.

Conclusion

Diagrams are useful in this area of taxation as they provide a clear structure of the method required to identify an individual’s tax position. When you learn these rules, make sure that you learn them as part of a coherent whole and not as a list of unrelated points.

Written by a member of the ATX-UK examining team

The comments in this article do not amount to advice on a particular matter and should not be taken as such. No reliance should be placed on the content of this article as the basis of any decision. The authors and the ACCA expressly disclaim all liability to any person in respect of any indirect, incidental, consequential or other damages relating to the use of this article.